Home

General Missionary Baptist

General Missionary Baptist

Covention of Georgia

2024 annual session

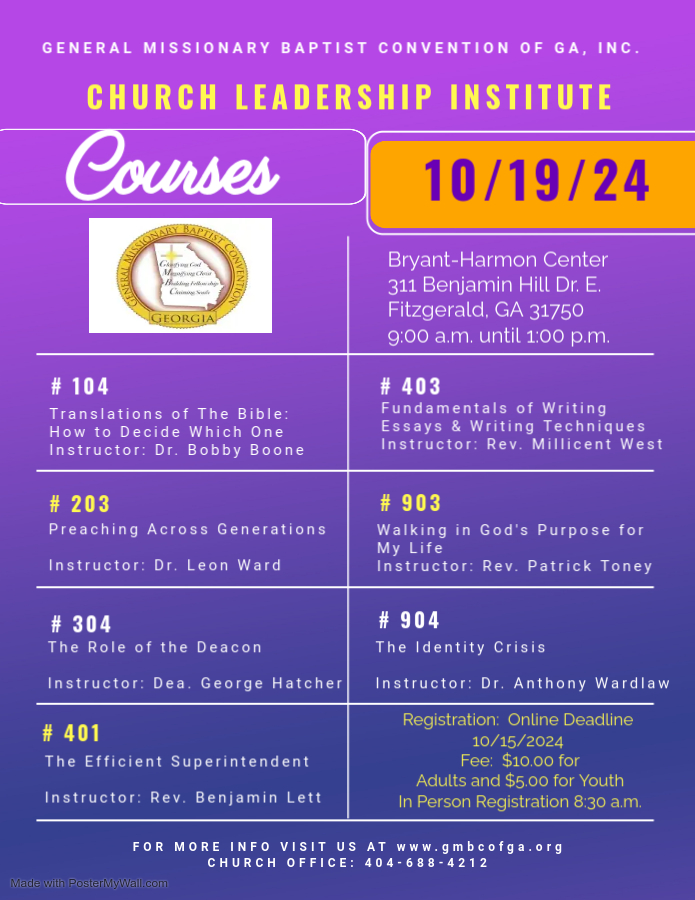

Church Leadership Institute

Diaster Relief

PREV

NEXT

GMBC Contact Info

General Missionary Baptist Convention Of Georgia

P. O. Box 92340

Atlanta, GA 30314

Tel (404) 688-4212

Fax (404) 997-7776

Email This email address is being protected from spambots. You need JavaScript enabled to view it.

C. M. Alexander - Land of Promise

P. O. Box 92340

Atlanta, GA 30314

Fax (404) 997-7776

(404) 688-4212